[ad_1]

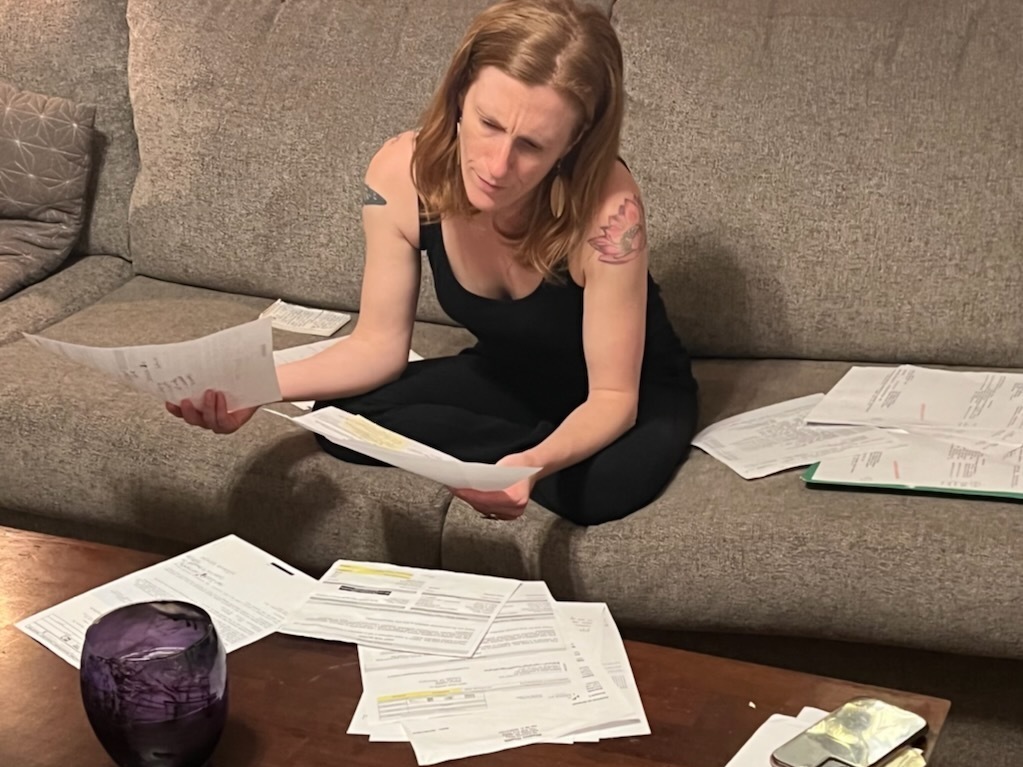

RALEIGH, N.C. — When Erin Williams-Reavis confronted a $3,500 surgical procedure invoice, the hospital provided to let her pay in $300 month-to-month installments. It was an excessive amount of, mentioned Williams-Reavis, 44, who lives in Greensboro, about an hour west of the state capital. Her hours as a private assistant had been reduce, and she or he and her husband have been behind on payments, even requesting a forbearance on their mortgage.

In Charlotte, Patrick Oliver was surprised to obtain a virtually $30,000 invoice after a visit to the emergency room for numbness and burning in his palms and ft. When Oliver, 66, and his spouse, Mary, could not pay, the hospital sued them. The couple feared they’d lose their dwelling.

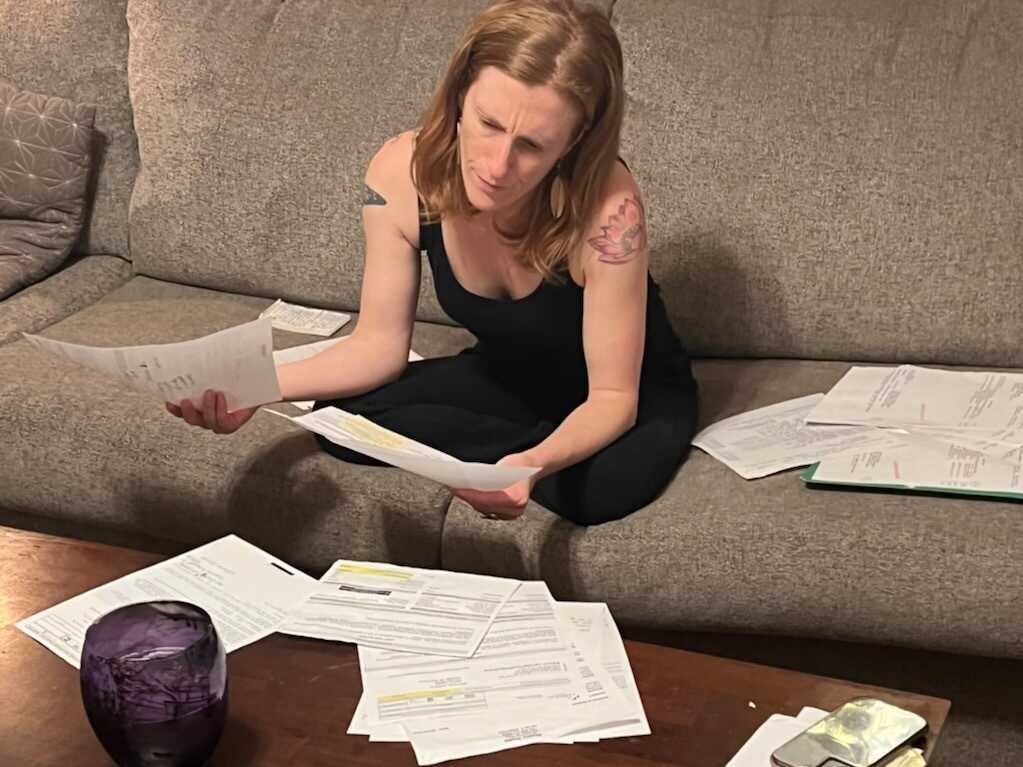

In Asheville, Emmaleigh Argonauta’s $25.72 medical invoice was despatched to collections. She mentioned that she’d paid the invoice however that the hospital system hadn’t recorded it. It took Argonauta eight months, a slew of calls and emails, and a full day on the billing workplace to resolve the debt.

Now, they’re all ready to see whether or not North Carolina’s lawmakers will make good on a invoice that its sponsors say will “de-weaponize medical debt.”

About 100 million individuals within the U.S. — 41% of adults — have some type of well being care debt, in line with a KFF poll carried out for a new KHN-NPR investigation. The issue is driving thousands and thousands of individuals into chapter 11, depleting financial savings and retirement accounts, and leaving black marks on credit score scores that make discovering housing or employment tough, the investigation discovered.

Emmaleigh Argonauta had a $25.72 medical invoice that ended up in collections. Though she’d paid, the hospital system in Asheville, N.C, hadn’t recorded it, she says. It took her eight months to get the debt resolved.

Mac Ellis

conceal caption

toggle caption

Mac Ellis

Emmaleigh Argonauta had a $25.72 medical invoice that ended up in collections. Though she’d paid, the hospital system in Asheville, N.C, hadn’t recorded it, she says. It took her eight months to get the debt resolved.

Mac Ellis

However federal protections stay weak. And the widespread burden has spurred efforts by at least a dozen state legislatures in recent times to raised defend sufferers. California, Maine, and Maryland have enacted measures that compel hospitals to broaden monetary help, crack down on debt collectors, and curb excessive practices corresponding to inserting liens on sufferers’ properties.

Many of those states have expanded Medicaid coverage by way of the Inexpensive Care Act, offering medical health insurance to thousands and thousands of beforehand uninsured individuals.

However some states with the very best ranges of medical debt, corresponding to Texas, South Carolina, and Tennessee, have few protections. Low-income, Black, and Indigenous individuals in these Southern states are among the many hardest hit. However even in additional liberal states corresponding to California, the well being care and debt assortment industries have foiled extra bold reform efforts.

The debt downside in North Carolina is among the many most acute within the nation, in line with credit bureau data analyzed by the nonprofit City Institute. Solely 5 states have a better share of residents with medical debt on their credit score reviews.

North Carolina lawmakers are debating two measures to sort out the state’s debt downside: one to broaden Medicaid, a authorities insurance coverage program for low-income individuals, and one other to strengthen monetary protections for sufferers. If each cross, coverage specialists say North Carolina might emerge as a nationwide chief in defending residents towards medical debt and aggressive assortment practices.

“Medical debt can drive individuals into poverty and forestall individuals and their households from getting out of poverty,” mentioned Mark Rukavina, a program director with the nonprofit well being advocacy group Group Catalyst. These payments might present “vital safety” towards that.

At the moment, North Carolina ranks twenty eighth on a nationwide scorecard of medical debt policies developed by the Innovation for Justice lab on the College of Arizona and the College of Utah. If North Carolina’s legislature passes each payments, the state would bounce to second, mentioned Gabriela Elizondo-Craig, a lead investigator on the scorecard venture. That might put it forward of California and just under Maryland, which, in line with the scorecard, is the one state that prohibits hospitals from promoting medical debt to different firms.

The North Carolina Senate passed the bill that features Medicaid enlargement after Republicans, who had beforehand opposed the transfer, threw their support behind it. Senate chief Phil Berger mentioned in a information convention that a rise in federal funds to encourage states to broaden this system, together with a latest overhaul of the state’s Medicaid program to make it extra environment friendly, ensured that doing so would not harm the state’s finances. Though the invoice faces an uphill battle within the Home, it might present insurance coverage protection to greater than 500,000 individuals.

Erin Williams-Reavis was provided $300 month-to-month funds to pay down a $3,500 surgical procedure invoice however couldn’t afford such excessive installments, she says.

Erin Williams-Reavis

conceal caption

toggle caption

Erin Williams-Reavis

“Medicaid enlargement would transcend hospital prices,” mentioned Jenifer Bosco, an lawyer on the Nationwide Shopper Legislation Heart who has co-authored a model state law on medical debt. “It will contact all well being care prices and pharmacy prices, which actually does have the potential to scale back or eradicate numerous medical debt for the lowest-income individuals.”

The second piece of laws, often known as the Medical Debt De-Weaponization Act, would require hospitals to supply monetary help to sufferers based mostly on their earnings and restrict the best way giant medical services and debt collectors can pursue unpaid payments. It contains a host of provisions championed by client advocates, together with the next:

- Require hospitals to offer free care to sufferers whose family earnings is at or beneath 200% of

- Require hospitals to supply sufferers fee plans that span not less than two years, with installments that do not exceed 5% of their month-to-month earnings

- Cap the annual out-of-pocket expense for many sufferers at $2,300

- Cap the utmost rate of interest on medical debt at 5%

- Protect relations from medical or nursing dwelling debt incurred by a partner or mother or father

- Delay reporting of unpaid medical money owed to credit score bureaus till one 12 months after a affected person is billed

- Prohibit dwelling foreclosures associated to medical debt

- Require the lawyer normal to implement the regulation and giving sufferers the flexibility to sue well being care services for violations

Not less than a dozen states have handed legal guidelines with comparable provisions in recent times, mentioned Quynh Chi Nguyen, a senior coverage analyst at Group Catalyst. As of 2021, 10 states — together with California, Illinois, and Maine — required hospitals to offer free or discounted care to sufferers who meet sure earnings thresholds. 13 states and Washington, D.C., restrict numerous debt assortment practices. In New Mexico, hospitals are prohibited from suing sufferers with incomes beneath 200% of the federal poverty stage, inserting liens on their property, or garnishing their wages. In Nevada, debt assortment companies are required to offer written discover to sufferers not less than 60 days earlier than any assortment motion is taken. Different state insurance policies have centered on value transparency or limiting the impression of debt on individuals’s credit score scores and livelihoods.

Earlier this 12 months, the three large credit-reporting agencies announced they may take away medical money owed of lower than $500 and people which were repaid from client credit score reviews. The Biden administration suggested federal lenders to no longer consider medical debt when evaluating mortgage purposes.

Collectively, these insurance policies can lower the variety of individuals pushed into poverty by medical payments or stored there era after era due to medical debt, Nguyen mentioned.

North Carolina’s medical debt laws was spurred by multiple reports from the treasurer’s workplace, which discovered that hospitals despatched practically $150 million in payments to sufferers who ought to have certified without spending a dime or discounted care beneath the hospitals’ insurance policies. A previous KHN investigation discovered comparable traits nationwide.

“Folks in North Carolina aren’t capable of see themselves out of poverty, not due to the conflict in Ukraine or inflation,” mentioned state Treasurer Dale Folwell, “however due to medical debt.”

State Rep. Ed Goodwin, a Republican who sponsored the invoice and represents two of the North Carolina counties with among the many highest shares of residents with medical debt, mentioned he believes there’s bipartisan help to sort out the difficulty. Goodwin urged that maybe this invoice shall be simpler to promote than Medicaid enlargement — which he mentioned has been mentioned for years “and never a complete lot has occurred.”

However that does not imply it’s going to be easy crusing.

At a committee hearing in early June, Republican state Rep. John Szoka mentioned “a lot of issues” within the invoice “greatly disturb” him. He questioned whether or not a credit score rating might considerably hurt somebody’s upward mobility and famous that federal legal guidelines already require nonprofit hospitals to offer monetary help. “I might not wish to see any hospital become social companies,” he added.

Related legal guidelines in different states have confronted opposition from highly effective hospital associations, and teams representing debt collectors typically criticize most of these protections.

The North Carolina Healthcare Affiliation, which represents hospitals within the state, mentioned it has not taken an official place but. However spokesperson Cynthia Charles mentioned current federal and state legal guidelines tackle many points associated to honest billing and collections.

Hospitals do “greater than another a part of the well being care area to help susceptible sufferers,” she wrote in a press release to KHN. They attempt to make it simple for sufferers to study monetary help by way of counselors, name facilities, digital chat instruments, and extra, she mentioned, nevertheless it’s “a two-way course of,” and sufferers should present monetary info to be certified.

The North Carolina Collectors Association declined to remark.

For individuals with onerous medical payments, the laws cannot come quick sufficient and might’t go far sufficient.

Emmaleigh Argonauta, who was despatched to collections over that faulty $26 invoice, mentioned the regulation must also require hospitals to offer an itemized invoice to each affected person, with out ready for them to request it.

Patrick and Mary Oliver, who have been sued by a hospital, mentioned well being programs must be clearer about the price of companies upfront and justify these prices.

Erin Williams-Reavis, who was provided the $300 month-to-month fee plan for her surgical procedure invoice, mentioned lawmakers ought to converse with extra “regular individuals” when revising the laws “as a result of we are the ones who’re affected.”

The medical debt invoice is at present beneath assessment by the Home banking committee, the place it’s prone to be revised. To cross into regulation this session, the invoice has simply two weeks left to make it by way of the North Carolina Home and Senate.

KHN senior correspondent Noam N. Levey contributed to this report.

KHN (Kaiser Well being Information) is a nationwide newsroom that produces in-depth journalism about well being points. It’s an editorially unbiased working program of KFF (Kaiser Household Basis).

[ad_2]

Source link